3 Easy Facts About Amur Capital Management Corporation Explained

3 Easy Facts About Amur Capital Management Corporation Explained

Blog Article

The Definitive Guide to Amur Capital Management Corporation

Table of ContentsIndicators on Amur Capital Management Corporation You Should KnowWhat Does Amur Capital Management Corporation Mean?Indicators on Amur Capital Management Corporation You Need To KnowAmur Capital Management Corporation Fundamentals ExplainedSome Ideas on Amur Capital Management Corporation You Need To KnowThe Best Strategy To Use For Amur Capital Management CorporationEverything about Amur Capital Management Corporation

A low P/E ratio may suggest that a firm is undervalued, or that capitalists expect the company to encounter more difficult times in advance. Financiers can utilize the average P/E proportion of various other business in the same industry to develop a standard.

The Ultimate Guide To Amur Capital Management Corporation

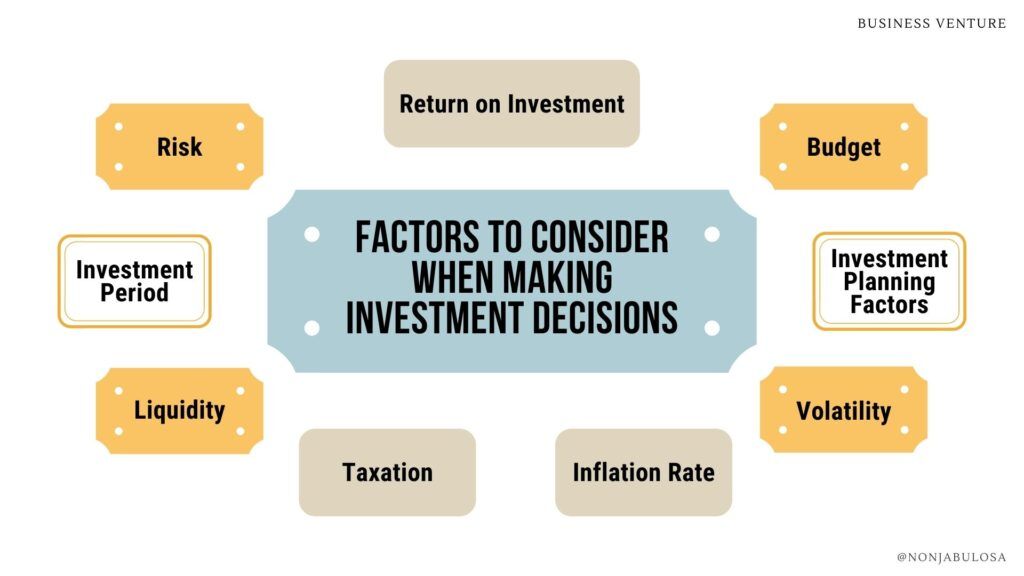

A stock's P/E ratio is very easy to find on most monetary reporting internet sites. This number suggests the volatility of a supply in comparison to the market as a whole.

A stock with a beta of above 1 is in theory more unpredictable than the market. For instance, a protection with a beta of 1.3 is 30% even more unpredictable than the marketplace. If the S&P 500 increases 5%, a stock with a beta of 1. https://www.bark.com/en/ca/company/amur-capital-management-corporation/kYQ8q/.3 can be anticipated to rise by 8%

An Unbiased View of Amur Capital Management Corporation

EPS is a dollar number standing for the portion of a business's profits, after tax obligations and recommended stock dividends, that is alloted per share of ordinary shares. Financiers can use this number to determine just how well a firm can deliver value to investors. A greater EPS begets greater share costs.

If a firm on a regular basis fails to supply on earnings projections, an investor might wish to reevaluate acquiring the supply - passive income. The computation is straightforward. If a business has an earnings of $40 million and pays $4 million in rewards, after that the remaining sum of $36 million is divided by the number of shares impressive

Amur Capital Management Corporation Fundamentals Explained

Capitalists usually obtain interested in a stock after reviewing headlines about its extraordinary performance. A look at the fad in rates over the previous 52 weeks at the least is needed to get a sense of where a stock's rate may go following.

Let's look at what these terms imply, how they vary and which one is finest for the ordinary financier. Technical analysts comb with massive quantities of information in an effort to anticipate the instructions of supply rates. The information is composed mainly of past rates info and trading quantity. Basic analysis fits the needs of a lot of financiers and has the advantage of making good sense in the genuine world.

They think rates comply with a pattern, and if they can understand the pattern they can profit from it with well-timed trades. In current years, technology has actually allowed more capitalists to exercise this style of investing because the devices and the data are extra available than ever before. Basic experts think about the intrinsic worth of a supply.

The Best Strategy To Use For Amur Capital Management Corporation

Numerous of the principles discussed throughout this item are usual in the fundamental analyst's world. Technical evaluation is ideal matched to someone that has the moment and comfort degree with data to put endless numbers to utilize. Otherwise, essential evaluation will certainly fit the demands of most investors, and it has the advantage of making great feeling in the actual globe.

Brokerage fees and shared fund expenditure ratios pull cash from your portfolio. Those expenses cost you today and in the future. Over a duration of 20 years, yearly charges of 0.50% on a $100,000 financial investment will minimize the portfolio's value by $10,000. Over the same period, a 1% cost will certainly reduce the exact same portfolio by $30,000.

The trend is with you (https://www.cybo.com/CA-biz/amur-capital-management-corporation). Take advantage of the fad and shop around for the lowest expense.

Some Known Incorrect Statements About Amur Capital Management Corporation

, environment-friendly space, beautiful views, and the area's status variable prominently into household property evaluations. A vital when thinking about property area is the mid-to-long-term sight pertaining to just how the location is expected to advance over the investment period.

The Main Principles Of Amur Capital Management Corporation

Completely examine the ownership and desired use of the immediate areas where you intend to spend. One way to gather information concerning the prospects of the vicinity of the property you are thinking about is to speak to the city center or various other public firms my review here accountable of zoning and city planning.

This supplies normal revenue and long-term worth appreciation. The personality to be a proprietor is required to deal with feasible disputes and lawful issues, handle occupants, repair, and so on. This is generally for fast, tiny to medium profitthe normal home is under construction and sold at a revenue on completion.

Report this page